2024 memory chip contract price forecast; Semiconductor IPO inventory; Power semiconductor prices start to rise?

2024-03-18 10:51:15

"Core" smell summary

Memory chip contract price forecast

Semiconductor IPO annual inventory

Power semiconductor prices start to rise?

Three acquisitions in two days

China integrated circuit import and export data

1

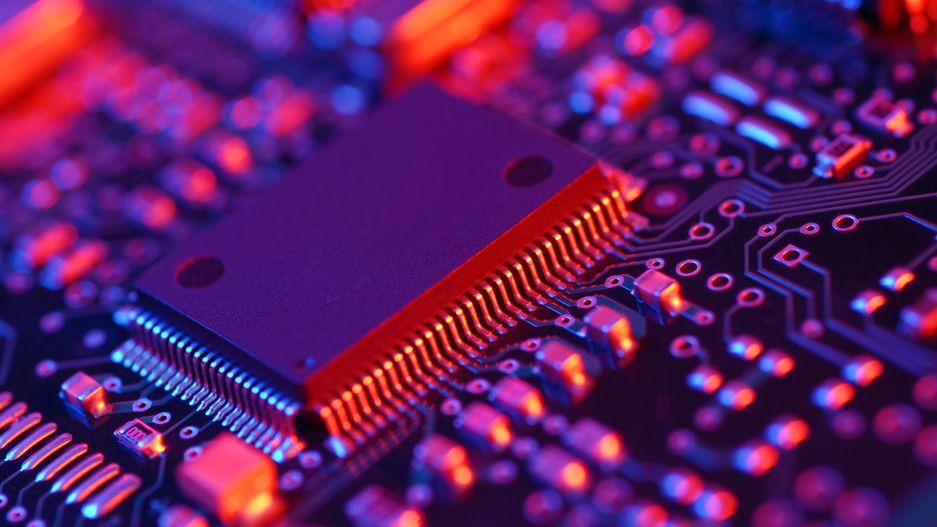

Memory chip contract price forecast

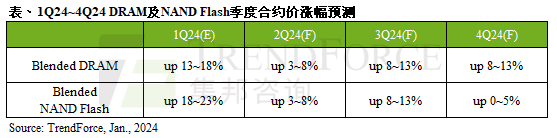

According to TrendForce Consulting research, DRAM product contract prices began to fall in the fourth quarter of 2021, fell for eight consecutive quarters, and rose in the fourth quarter of 2023. In terms of NAND Flash, the contract price began to decline in the third quarter of 2022, fell for four consecutive seasons, and rose from the third quarter of 2023. In the face of a conservative market demand outlook for 2024, the price trend of both depends on the capacity utilization of suppliers.

Among them, in view of the price trend in the first quarter, TrendForce Consulting forecast that the DRAM contract price will increase by about 13 to 18%. NAND Flash is 18 to 23 percent. However, in the second quarter, the quarterly price increase of DRAM and NAND Flash contracts converged to 3-8%.

The third quarter entered the traditional peak season, and the quarterly price increase of the two contracts has the opportunity to expand to 8-13%. Among them, DRAM, due to the increase in DDR5 and HBM penetration, benefited from the increase in the average unit price, led to the expansion of DRAM growth. For more details, please click | DRAM, NAND Flash Quarterly Contract Price Forecast in 2024.

2

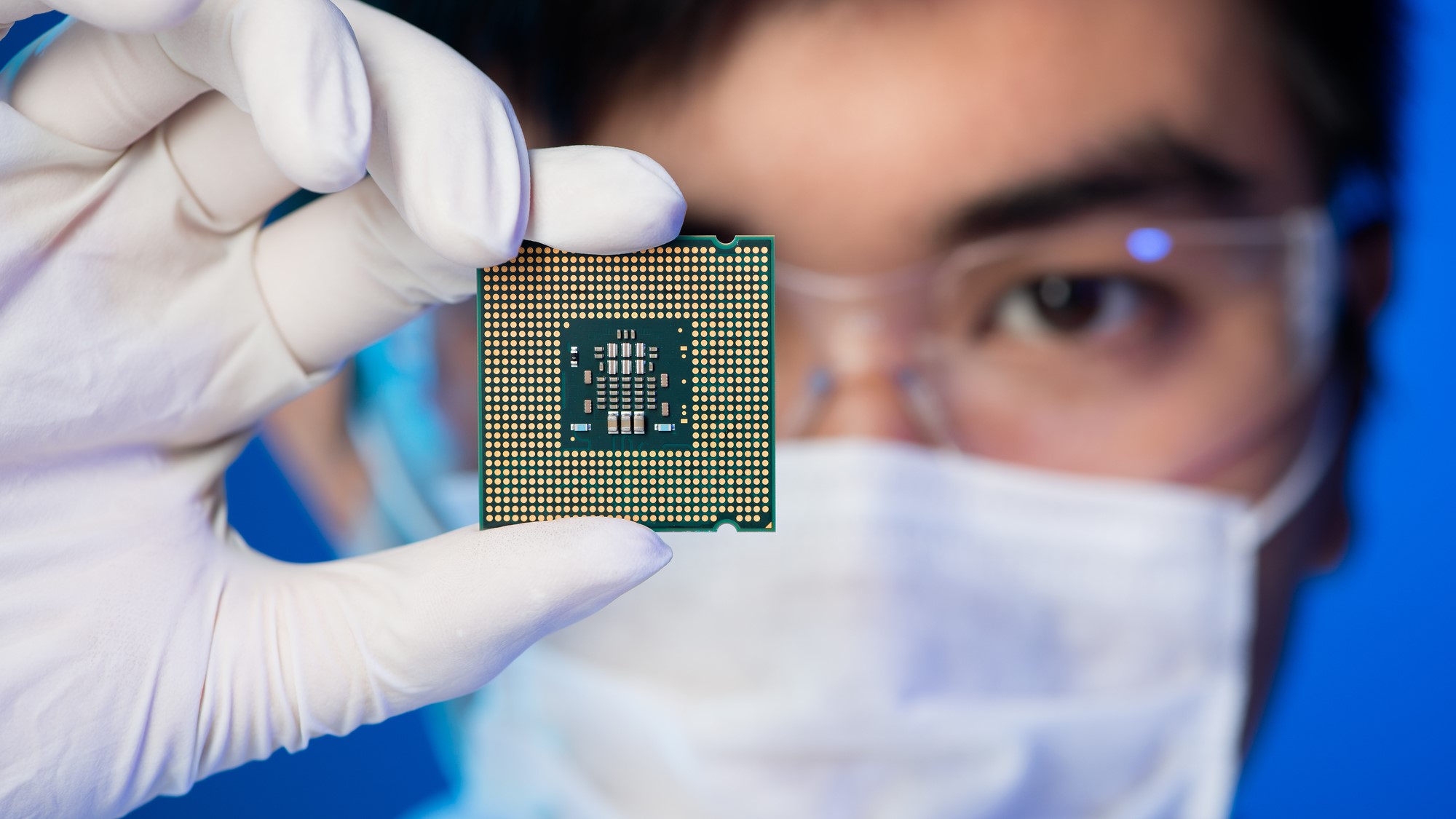

Semiconductor IPO annual inventory

In 2023, under the impact of global economic headwinds and weak consumer electronics market factors, the semiconductor industry experienced a downward adjustment cycle. In the capital market, due to the tightening of the IPO policy of the CSRC, the listing progress of the semiconductor industry in 2023 has slowed down, the number of listed companies and the financing scale have decreased, and some companies have terminated their ipos, but there are still many bright spots in the semiconductor IPO field in 2023.

Global Semiconductor Watch incomplete statistics, a total of 23 semiconductor related companies successfully listed last year, the market value of more than 300 billion yuan. Another 60 semiconductor ipos have made the latest progress and are expected to land in the capital market in the future. Listed and queuing enterprises are involved in the industrial chain of materials, equipment, IC design, wafer foundry, sealing and testing, and the application fields cover the Internet of Things, display, image sensors, automotive chips, memory and many other industries.... For more details, please click on the annual inventory | semiconductor IPO: 23 successful listings, 60 ready to go, Where to go in the future?

3

Power semiconductor prices start to rise?

From 2019 to 2022, the downstream demand for new energy vehicles, photovoltaic, semiconductors and other technologies continues to be strong, the global wafer capacity is insufficient, the power semiconductor industry is in short supply, and there have been many price increases, of which IGBT, SiC MOSFET and so on are very tight. Since 2022, the global production capacity has been gradually released, and the power semiconductor market has fallen, from two transistors, transistors, low and medium voltage MOS to high voltage MOS, supply and demand have reversed and sharply reduced prices; In addition, under the background of the weak consumer electronics market, inventory reduction has become the main theme of the power semiconductor market in the past two years.

However, from December 2023 to January this year, the media reported that five local power semiconductor manufacturers, including Jiejie Micro electricity, Sanlian Sheng, Blue color Electronics, Yangzhou Jingxin, and Deep Micro Company, have issued price increases and adjusted their product prices. At present, the power semiconductor inventory is significantly reduced, and the terminal demand is gradually showing signs of recovery, has the power semiconductor industry bottomed out? ... For more details, please click "Price increase letter flying, power semiconductor riding the trend?"

4

Integrated circuit import and export data

According to the latest data released by the General Administration of Customs of China, in 2023, China's import and export volume and value of integrated circuits (ics) have declined. It is worth noting that China is constantly increasing local chip production to cope with future long-term development.

In terms of import data, China will import 479.5 billion integrated circuits in 2023, down 10.8% from 2022; Imports amounted to US $349.4 billion, down 15.4 percent. In addition, China's imports of diodes and similar semiconductor components (representative of common commodity chips) also fell by 23.8% in 2023. In terms of export data, China's cumulative export of integrated circuits in 2023 is 267.8 billion, down 1.8% from 2022; Exports amounted to $13600, down 10.1%.

2023 Under the influence of economic headwinds, the global consumer electronics, especially smart phones and laptops, continue to weaken. In addition, under the relevant export control measures in foreign countries, China is seriously limited in the purchase of some advanced chips. At present, China is constantly increasing local production to reduce the impact of dependence on imported chips. For more information, please click "2023 China chip: Imports fell 15.4%, imports fell 10.8%"

5

Three acquisitions in two days

Entering 2024, mergers and acquisitions in the semiconductor industry are hot, and on January 15 and 16, three acquisitions occurred in the semiconductor industry.

On January 15, the chip design company S.H.I.E.L.D. announced that it held a board meeting with Qianzhan Technology respectively, and passed the acquisition of 100% of the issued shares of Qianzhan Technology in cash and new shares issued by S.H.I.E.L.D. On the same day, chip design service manufacturer Zhiyuan announced that the company acquired Aragio Solution, an American IP supplier of TSMC, for $20 million (about 144 million yuan) and obtained 100% of the company's common shares.

On January 16, EDA and the semiconductor IP giant Sixes Technology and the industrial software giant Ansys officially announced that the two sides have reached a final agreement on the acquisition of Ansys by Sixes Technology. The total value of the acquisition is about $35 billion, which is the largest merger and acquisition in 2024, and from the transaction value of $35 billion (about 250 billion yuan), the acquisition is one of the largest deals announced in the technology industry in recent years. For more information, please click on "Three mergers and Acquisitions in Two Days, involving EDA's Largest Global Acquisition in 2024!"